Insurance Payments

Posting of insurance payments involves logging the payment into the practice management or billing software. Insurance payers typically lump payments together for several claims in one check or electronic funds deposit. This is reflected on the ERA.

Apply insurance payment involves reconciling the payments received from the insurance payer to each individual claim. Once insurance payments are posted, any secondary claims can then be created and submitted. Once all insurance payments have been received and account adjustments made, the remaining patient responsibility can then be billed.

ERA’s & EOB’s

ERA – Electronic Remittance Advice. This is an explanation of the insurance processing sent electronically to the provider. A paper copy is called the Remittance Advice (RA). The ERA may include multiple patients on one remittance and send one check (or EFT deposit) for several claims. Electronic ERA’s follow a universal format called 835 (ANSI format) so they can be compatible with any software that can upload ERA files.

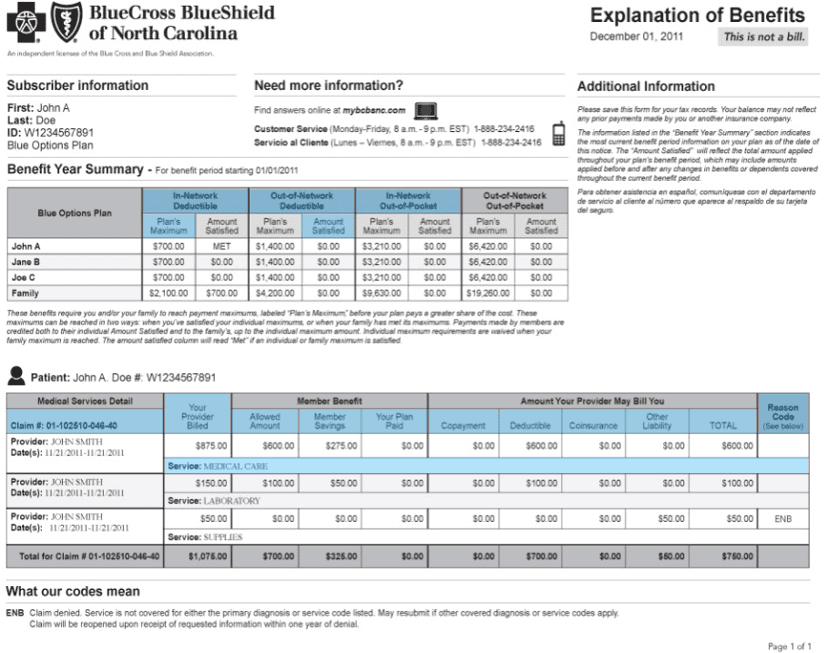

EOB – Explanation of Benefits. This provides the patient with an explanation of the claim process. It also explains any patient responsibilities such as co-insurance, deductible, and copays.

Terms used on ERA’s & EOB’s

Billed Amount – What provider billed insurance payer.

Allowed Amount – What insurance payer allows for a service.

Not Covered – Amount not covered by patients policy.

Deductible – Amount applied to patient deductible that they have to pay.

Provider Paid – Amount the insurance pays the provider.

Adjustment – Amount insurance payment is reduced due to adjustment. There can be several reasons for adjustment as explained by the Claim Adjustment Reason Code (CARC).

Patient Responsibility – How must the patient must pay the provider.

Example ERA

Example EOB

Patient Statements

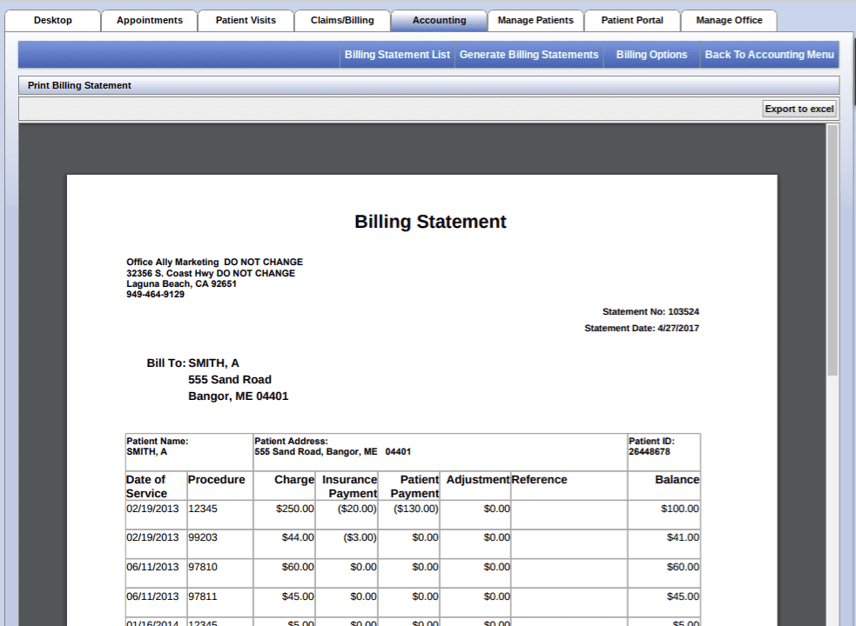

Once all insurance and patient payments have been posted and applied to the patients account, a patient statement is created in the practice management software for any remaining patient balance.

Below is an example of a patient statement created and previewed in the practice management software.

Below is an example of a patient statement created in the medical billing software.

Patient Collections

Patient collections are necessary when a patient has been sent multiple statements and either cannot pay or make no attempt to pay.

Typically occurs after 90 days.

May want to employ “soft collections” first before turning over to collections:

- Send final notice that account may be sent to collections if payment is not received or arrangements made.

- Phone call to remind patient of account status and see if they can make a payment.

- Work cooperatively with patient to help resolve account.

If reason is due to wrong address, you really don’t want to send to collections if this can be resolved with simple phone call reminder.

Accounts Receivables & Aging Reports

Aging reports show the Accounts Receivable (A/R) for outstanding billed accounts. These reports are created using the practice management software and typically show outstanding balances at 30, 60, 90, and 120 days.

The aging reports are helpful in recognizing overdue accounts and identifying where follow up is needed, and acessing overall billing effectiveness.

Insurance aging reports show outstanding accounts billing to insurance payers (a claim was filed) but payment has not yet been received, posted, or applied. Patient aging reports show outstanding balances for accounts that have received insurance payments and adjustments and have a remaining patient balance. Accounts over 90 days should be less than 20% of the total Accounts Receivables for a healthy practice.

Example of Insurance Aging Report

This topic covered in more detail in Online Fundamentals of Medical Billing Course